- Crypto Intel

- Posts

- One Quiet Corner Delivered 79% Overnight—Here's Why You Need to Watch

One Quiet Corner Delivered 79% Overnight—Here's Why You Need to Watch

Public companies now control more than 1 million BTC. Asia is stepping in with a $1B treasury fund. And Europe is still fighting over a digital euro while stablecoins surge ahead.

With so much going on, here’s where you need to watch right now.

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

This week wasn't about charts—it was about power plays.

Corporates are locking up supply, Asia is scaling its treasury game, and EU policymakers are still dragging their feet on CBDCs.

Smart investors are already reading between the lines.

Bitcoin Treasuries

Public Companies Pass 1 Million BTC, Now Hold 5.1% of Supply

Corporate Bitcoin adoption has crossed a milestone: 1,000,698 BTC on the balance sheets of 184 public companies worldwide.

That's $111 billion worth of BTC, equal to 5.1% of supply.

Strategy remains the undisputed leader, holding 636,505 BTC since launching its treasury strategy in 2020. Marathon Digital follows with 52,477 BTC after adding 705 BTC in August.

New entrants are quickly rising, including Jack Mallers' XXI with 43,514 BTC and Bitcoin Standard Treasury Company with 30,021 BTC.

Exchanges and firms like Bullish, Metaplanet, Riot, and Coinbase round out the top 10.

The milestone reflects a demand shock this cycle, pushing Bitcoin to new highs above $124,000. With only 5.2% of supply left to be mined, competition for coins is heating up.

Some companies, like Metaplanet and Semler Scientific, have ambitious goals of scaling holdings 10–20x by 2027.

Wall Street tools like convertible notes and SPACs are fueling this growth.

Global adoption is expanding too, with corporate treasuries spread across the US, Canada, Europe, Asia, and beyond.

Still, ETFs and governments hold even more, tightening supply further.

For investors, this milestone signals that corporate adoption is becoming self-reinforcing. The more companies commit, the scarcer BTC becomes, raising the stakes for those still on the sidelines.

Institutional Investment

Sora Ventures Launches $1B Bitcoin Treasury Fund in Asia

Sora Ventures unveiled Asia's first dedicated Bitcoin treasury fund with a plan to buy $1 billion in BTC over six months.

The fund has already secured $200 million in regional commitments.

The announcement came at Taipei Blockchain Week, highlighting Asia's growing role in corporate Bitcoin adoption.

Until now, most treasury strategies have been centered in the US and Europe.

Sora says the fund will strengthen Asia's network of treasury firms, giving institutions new ways to pool capital into BTC.

Partners include companies in Japan, Hong Kong, Thailand, and South Korea.

Metaplanet, Japan's largest Bitcoin treasury holder, currently leads with 20,000 BTC. Sora has backed Metaplanet before and recently expanded with acquisitions across Asia.

Jason Fang, Sora's founder, said the initiative proves Asia is becoming a serious player in Bitcoin finance.

Partner Luke Liu added it's the first time the region has seen such a scale of commitment.

The launch comes as public companies worldwide control over 1 million BTC, with Strategy still dominating. Sora's move signals that Asia doesn't want to be left behind.

For investors, Asia's entry into large-scale treasury strategies suggests Bitcoin demand is spreading geographically.

That broadening base may cushion volatility and extend the cycle beyond US-driven momentum.

Poll: If Bitcoin hit $1M, what’s your first move? |

Unlock Income Streams (Sponsored)

The market’s wild swings—like a 427‑point drop one day and a 619‑point rally the next—are enough to make anyone’s head spin.

With Washington trade talks and Fed policy chatter fueling volatility, you need a proven playbook.

Grab our FREE e‑book, Mastering Options Trading: A Beginner’s Guide, and discover:

Market‑proof strategies for up, down, or sideways moves

Easy income tactics that work in any climate

Smart discount buys to snag top stocks at lower prices

Advanced setups favored by pros for rapid growth

Dividend‑option combos that lock in extra premium

Don’t let this chaos pass you by.

Policy

EU Lawmakers Push Back as ECB Renews Digital Euro Pitch

The European Central Bank renewed its push for a digital euro, calling it a free and universal fallback payment option.

Lawmakers, however, remain skeptical of its privacy guarantees and banking impact.

ECB board member Piero Cipollone pitched it as insurance against crises like cyberattacks or payment network outages.

He said the digital euro would "complement" cash, not replace it.

Some parliamentarians warned it could undermine commercial banks if citizens moved deposits into ECB-backed accounts.

Others doubted whether the privacy protections would truly mirror cash.

Cipollone stressed that the ECB "will not know anything about the payer and payee" in offline mode. He also insisted caps on accounts would be set with "rigorous analysis."

Still, critics argue such caps could be lifted in a crisis, creating systemic risk. One lawmaker said the private sector could be emptied of deposits overnight.

Legislation has been stuck in parliament since 2023, but could advance by 2026. A launch wouldn't likely arrive until 2029 at the earliest.

For investors, the debate shows Europe's digital money path remains politically fraught.

If adoption stalls, euro-denominated stablecoins may continue filling the gap in European digital payments.

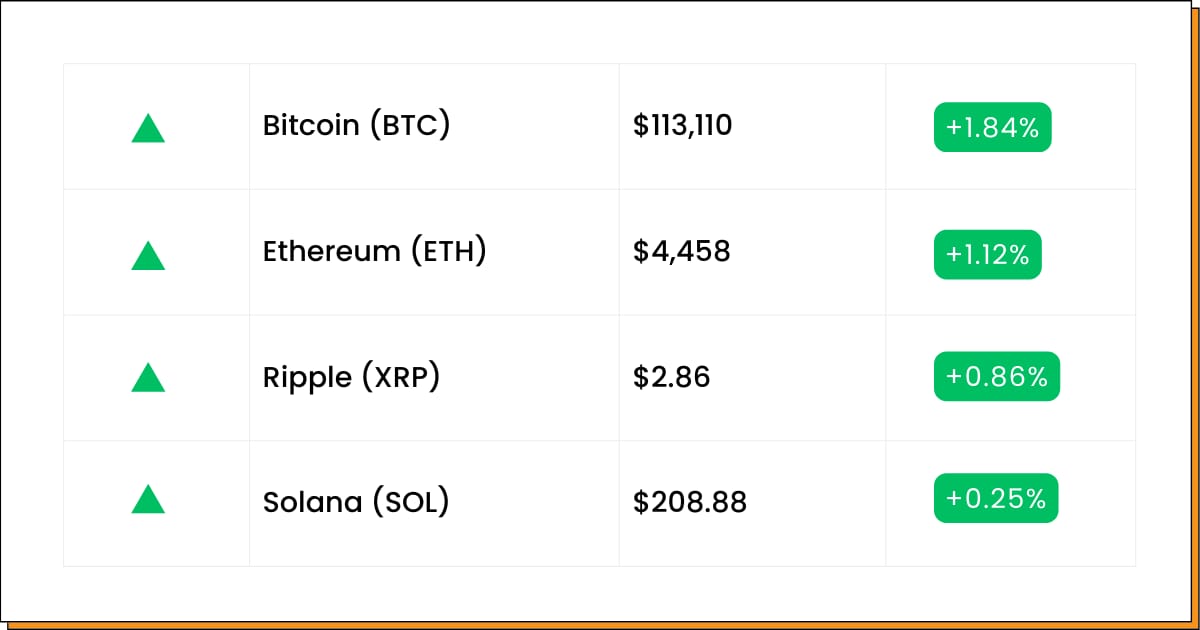

Coin Leaderboard

Crypto Pulse

Low-cap momentum is stirring again, with Jelly-My-Jelly leading the pack on a nearly 28% breakout.

While institutions load up on Bitcoin and Ether, nimble traders are chasing alpha in corners the spotlight hasn't hit—yet.

Tradoor (TRADOOR) $1.72 (+79.32%)

TRADOOR spiked 79.32% after debuting on Bitget's Innovation Zone.

Portal To Bitcoin (PTB) $0.04848 (+73.12%)

PTB rallied 73.12% on the back of fresh listings across KuCoin, Binance, Bitget, and others.

RedStone (RED) $0.6962 (+66.67%)

RED climbed 66.67% following its new listing on South Korea's Upbit exchange.

Early Advantage (Sponsored)

Most portfolios deliver “average.”

But if you’re reading this, you’re not after average.

That’s why our team just unveiled 5 carefully selected stocks with the potential to deliver massive upside.

What sets them apart?

Fundamentals that suggest staying power

Past reports from this series have highlighted stocks that posted gains of +175%, +498%, and even +673%.¹

Now, it’s your chance to see the latest 5 picks—completely free.

[Click here to claim your copy before midnight tonight]

Extraordinary opportunities don’t come often. Don’t miss this one.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Future Forward

Great trades rarely arrive with fireworks. They build quietly in the shadows, only breaking cover once the crowd has already moved on.

The market's main act is still running, but the real script is being written offstage. If you're looking closely, the side story may end up being the headline.

Crypto Conferences:

💎 AIBThings 2025 (Sep 6, 2025)

💎 Future Proof Festival 2025 (Sep 7, 2025)

💎 Block Jam 2025 (Sep 7, 2025)

Upcoming Airdrops:

🎁 Stronghold (SHX) Airdrop (Sep 7, 2025)

🎁 Mitosis (MITO) Airdrop (by Sep 11, 2025)

🎁 Solana Name Service (SNS) Airdrop (by Sep 21, 2025)

Upcoming Token Launches:

🚀 Dynamo Protocol (DYNAMO) IDO on KingdomStarter (Sep 6, 2025)

🚀 UOMI (UOMI) IDO on Spores (Sep 6, 2025)

🚀 TransferMole (AIPAY) TGE and Distribution (Sep 30, 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is World Liberty Financial?

World Liberty Financial (WLFI) is a crypto protocol linked to Donald Trump's business network that launched in 2025 with a high-profile token debut.

It attracted attention for its mix of politics, finance, and celebrity backing.

The project issues WLFI tokens and has plans for a USD1 stablecoin, designed to run partly on the Tron blockchain.

That's why Justin Sun, founder of Tron, became one of its key early investors.

WLFI's launch wasn't smooth—its token price dropped sharply, leading the team to begin buyback-and-burn programs.

More recently, controversy hit after Sun's wallet holding millions of WLFI was blacklisted by the project itself.

For now, WLFI sits at the intersection of crypto and politics, with a mix of hype, skepticism, and investor drama.

Whether it becomes a serious player or just another cycle's headline act depends on how it handles governance, trust, and utility.

Everything Else

Stripe and Paradigm unveiled Tempo, a high-speed blockchain for stablecoin payments backed by partners like Visa, OpenAI, and Deutsche Bank.

World Liberty Financial blacklisted Justin Sun's wallet holding $107M in WLFI tokens, sparking a 20% daily price drop and investor backlash.

French police rescued a 20-year-old Swiss man in Valence and detained seven suspects amid a surge in violent crypto-related kidnappings.

Wyoming's FRNT stablecoin expanded to Hedera after its multi-chain launch in August, though it still isn't available for public purchase.

Tether held talks to invest in gold mining as part of its broader exposure to precious metals, building on its $8.7B in gold reserves.

This week showed how fast the game is shifting—corporates stacking BTC, Asia building its own treasury muscle, and Europe still tangled in debates.

The real winners are the ones who see the shifts early, not when the spotlight is already blinding.

Best Regards,

— Benjamin Vitaris

Crypto Intel