- Crypto Intel

- Posts

- The 255% Acquisition Aftershock That Paid Off Big

The 255% Acquisition Aftershock That Paid Off Big

Hello and welcome to Crypto Intel, the twice-weekly newsletter covering the latest updates, breaking news, and exciting opportunities in the crypto world.

Not every market shift shows up in red candles or green bars. Some arrive in whispered deals, legal warnings, and quiet power plays.

This week, the narrative didn't revolve around hype or headlines—it lurked beneath them.

A currency fight reignited, a personal tragedy exposed systemic risks, and institutions moved like they knew something most don't.

Old patterns are breaking in silence. And when they do, they don't just move prices—they change the rules entirely.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Buy Before Surge (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Market-Moving News

No single story stole the spotlight—but together, they rewrote it. From Asia to Europe to Wall Street, coordinated moves hinted at a deeper reshuffle underway.

Stablecoins are no longer just about payments—they're geopolitical. Personal security is now part of the investor's risk profile.

And as capital floods back into Bitcoin ETFs, one thing's clear: the smart money isn't waiting for permission.

Stablecoins

JD.com, Ant Group Push for Yuan Stablecoins in Hong Kong

JD.com and Ant Group are lobbying China's central bank to allow yuan-based stablecoins to be issued offshore.

The goal is to use Hong Kong as a base for digital yuan-pegged tokens that can challenge dollar dominance.

Both firms are already set to issue HKD-backed stablecoins starting August 1 under Hong Kong's new crypto licensing regime.

Now, they want permission to issue CNH-backed coins—stablecoins tied to the offshore renminbi.

JD.com sees this as a key step toward yuan internationalization and reducing global reliance on dollar-linked digital assets.

The proposal also aligns with Beijing's long-term ambition to strengthen the renminbi's role in cross-border finance.

China maintains a strict ban on crypto transactions within its mainland, including privately issued stablecoins.

That crackdown intensified in 2021, forcing many crypto projects to relocate or dissolve.

Instead, China focused on developing its own central bank digital currency—the digital yuan or e-CNY.

While this is aimed at domestic use, offshore stablecoins could complement it as a bridge to international markets.

Ant Group and JD.com's push adds pressure to regulators weighing whether digital finance should remain state-led or allow more private-sector involvement.

The offshore model would provide flexibility while keeping Beijing in control. For investors, this signals a strategic phase in the stablecoin wars.

A yuan stablecoin from major Chinese firms could reshape cross-border payment flows—especially in Asia—and chip away at the dollar's digital stronghold.

Crime

Belgian Court Sentences Three in Crypto Kidnapping Case

A Belgian court has sentenced three men to 12 years in prison for kidnapping the wife of local crypto investor Stéphane Winkel.

The woman was abducted outside her home in December 2024 and held for ransom in crypto.

Winkel immediately alerted authorities, prompting a high-speed pursuit that ended with police intercepting the van and rescuing his wife.

The court also ordered the kidnappers to pay over €1 million in damages.

The suspects claimed they were forced into the act under threat of death, but the court rejected the defense.

The masterminds behind the plot remain unidentified and are still at large.

One of the individuals involved was a minor and is being tried separately in juvenile court. The rest were convicted of hostage-taking, criminal conspiracy, and extortion.

Winkel, a well-known educator in the crypto space, temporarily stepped back from public life following the incident.

He has since returned to YouTube with a new off-camera format, citing safety concerns.

Other high-profile crypto-related kidnappings have been reported across France and the broader EU in recent months.

These incidents are raising alarms about the risks faced by crypto influencers and investors.

For investors, this is a chilling reminder that visibility comes with vulnerability. In an age of wallet-linked identities, staying anonymous might be more valuable than ever.

AI Stocks (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Markets

Bitcoin ETF Inflows Hit $601M as Risk Appetite Returns

Bitcoin ETFs saw their strongest daily inflow in over a month, pulling in $601.8 million on Thursday.

BlackRock's IBIT and Fidelity's FBTC led the charge, with $224.5 and $237.1, respectively.

The rally comes as markets brace for Trump's new tax and spending bill, which could inject volatility into bond markets.

Some analysts see this as a cue for renewed crypto interest amid fiscal expansion.

ETF flows tend to lag by a day, but this burst likely reflects July 2 activity. Bitcoin briefly topped $110K before pulling back to the $109K range as traders reacted to jobs data.

Ark Invest's ARKB added another $114.2 million in flows, while Grayscale's GBTC and Franklin's EZBC saw no net movement. ETF vehicles remain the dominant path for large-scale Bitcoin exposure.

Trump's "Big Beautiful Bill" is set to become law on Independence Day. Some, like Arthur Hayes, warn it could cause a short-term liquidity crunch as the Treasury refills its accounts.

Still, market action shows growing willingness to front-run expansionary fiscal policy. Institutions appear to be repositioning ahead of the next macro shift.

For investors, ETF flows are a proxy for sentiment—and right now, that sentiment looks quietly bullish. Just don't forget: what flows in fast can also reverse just as quickly.

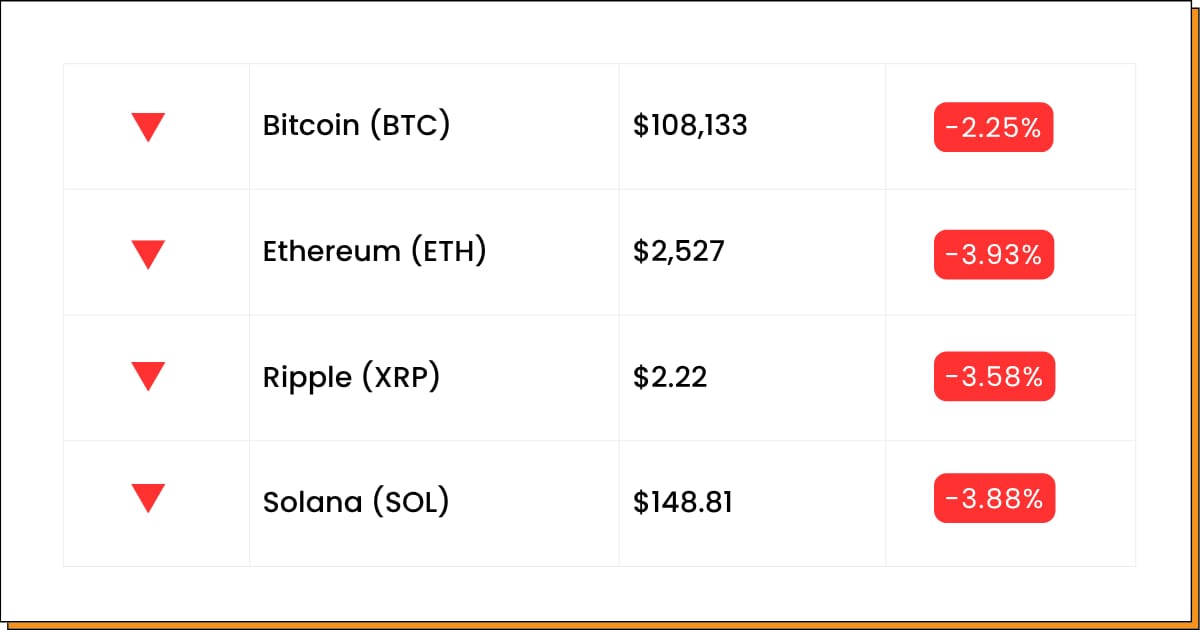

Coin Leaderboard

Crypto Pulse

Momentum didn't just return—it detonated.

One token rocketed over 250% on a delayed acquisition bounce, while others clawed back from steep losses or rode a fresh wave of hype.

These weren't your average pumps. Each move came after a pressure build—then snapped clean the moment the narrative flipped. 📈

Kwenta (KWENTA) $32.45 (+255.43%)

Over six months after Synthetix acquired the protocol, KWENTA exploded 255.43%, topping today's Crypto Pulse leaderboard.

LOBO•THE•WOLF•PUP (LOBO) $0.0006792 (+131.34%)

Fueled by viral momentum and speculative hype, LOBO surged 131.34% in just 24 hours.

Guild of Guardians (GOG) $0.02306 (+106.22%)

After crashing hard between June 30 and July 3, GOG staged a full rebound with a 106.22% rally to new local highs.

Steady Performers (Sponsored)

Every strong portfolio starts with a reliable core — and this new report may help investors build exactly that.

“7 Stocks to Buy and Hold Forever” highlights a group of companies with a track record of steady performance, strong fundamentals, and long-term growth potential.

These stocks were chosen for a reason — and could help lay the groundwork for a strategy built to outlast short-term swings.

Future Forward

Major shifts rarely kick down the door—they slip in through side exits when no one's watching. One detail changes, and suddenly the entire market feels off balance.

Miss the signal, and you're chasing momentum that's already halfway through. Spot it early, and you're not reacting—you're already there.

Crypto Conferences:

💎 ABF FinTech Awards 2025 (Jul 8, 2025)

💎 Mindset Summit US Strategy for AI and Crypto (Jul 8, 2025)

💎 RAISE Summit 2025 (Jul 8, 2025)

Upcoming Airdrops:

🎁 Matchain (MAT) Airdrop (by Jul 6, 2025)

🎁 ApeX (APEX) Airdrop (Jul 15, 2025)

🎁 Nexpace (NXPC) Airdrop (May 15, 2025 - Aug 15, 2025)

Upcoming Token Launches:

🚀 Tren Finance (TREN) IDO on CastrumPad (Jul 6, 2025)

🚀 TAIX AI (TAIX) IDO on Seedify (Jul 7, 2025)

🚀 Catex (CATX) IDO on Spores (Jul 11, 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Ondo Finance?

Ondo Finance is a crypto platform focused on bringing traditional finance—like bonds and stocks—onto the blockchain.

It offers tokenized versions of real-world assets so they can be traded more efficiently and around the clock.

The platform already manages over $1.4 billion in tokenized assets. These include tokenized US Treasuries, which let crypto users earn stable, real-world yield on-chain.

Ondo is now expanding into tokenized stocks by acquiring Oasis Pro, a US-regulated broker.

This gives it key licenses to trade and settle digital securities legally in the United States.

For investors, Ondo is part of a bigger trend: bringing the benefits of blockchain (like speed, transparency, and 24/7 access) to traditional financial products.

It's where DeFi and Wall Street start to overlap.

Everything Else

A solo Bitcoin miner with just 2.3 petahashes of hashrate beat 1-in-375,000 odds to mine a full block and earn $349,000 in BTC.

US Republicans have designated mid-July as "Crypto Week" to push forward three major bills on stablecoins, market structure, and a CBDC ban.

Russian state-owned giant Rostec plans to launch a ruble-pegged stablecoin called RUBx and a payment system on the Tron blockchain by year-end.

Ondo Finance will acquire SEC-regulated broker Oasis Pro to fast-track its tokenized stock rollout with licenses for trading and transfer.

Riot, Cipher, and MARA cut June Bitcoin production to avoid peak energy costs in Texas, while CleanSpark bucked the trend with increased output.

That's our coverage for today; thanks for reading! Reply to this email with feedback or any cryptocurrencies you want me to check out.

Best Regards,

— Benjamin Vitaris

Crypto Intel