- Crypto Intel

- Posts

- The 67% Rally That Hid a Bigger Shift

The 67% Rally That Hid a Bigger Shift

Hello and welcome to Crypto Intel, the twice-weekly newsletter covering the latest updates, breaking news, and exciting opportunities in the crypto world.

It looked like a meme pump. But behind the 67% surge was something more.

There was sentiment rotation, exchange mechanics, and a market still very much alive beneath the surface.

While microcaps took flight, a courtroom ruling clipped expectations for accountability in digital ventures. A stablecoin giant rewrote its roadmap.

And the world’s most valuable crypto asset leapfrogged Big Tech on the global leaderboard.

Momentum may have led the charge, but structure, regulation, and infrastructure told the real story.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Buy & Hold (Sponsored)

Every strong portfolio starts with a reliable core — and this new report may help investors build exactly that.

“7 Stocks to Buy and Hold Forever” highlights a group of companies with a track record of steady performance, strong fundamentals, and long-term growth potential.

These stocks were chosen for a reason — and could help lay the groundwork for a strategy built to outlast short-term swings.

Market-Moving News

The flashiest move wasn’t the most important.

A federal judge dismissed claims against a major brand in an NFT dispute, shifting legal precedent for U.S.-based suits.

Tether froze redemptions across five legacy chains, signaling a hard pivot toward high-utility networks.

And Bitcoin surpassed Amazon in market value, officially becoming the world’s fifth-largest asset.

The cycle is recalibrating. And it’s one that’s rewarding the bold, and testing what’s built to last.

NFTs

Judge Dismisses Dolce & Gabbana USA From $25M NFT Lawsuit

A federal judge has dismissed a proposed class-action lawsuit against Dolce & Gabbana USA over its alleged role in a failed $25 million NFT project.

The ruling, issued by Judge Naomi Reice Buchwald, concluded that the U.S. division of the luxury fashion brand could not be held liable for the actions of its Italy-based parent company, which ran the DGFamily NFT collection.

The lawsuit, originally filed in May 2024, claimed investors were promised digital wearables, physical luxury goods, and exclusive access to events through eight quarterly “drops.”

However, according to the plaintiffs, many of these benefits were delayed, incomplete, or never delivered. One plaintiff said he lost $5,800, calling the project a “rug pull.”

Judge Buchwald found no evidence that Dolce & Gabbana USA operated as an “alter ego” of the parent company.

She criticized the “group pleading” approach, where both entities were referred to jointly as “Dolce & Gabbana,” with no clarity about who was responsible for what.

The plaintiff’s request to amend the complaint again was also denied.

The case highlights the legal challenges facing NFT buyers seeking redress across international corporate structures.

With foreign defendants like UNXD Inc. (Dubai) and Bluebear Italia SRL (Italy) still unserved, the suit has effectively stalled.

As the NFT market matures and cools, cases like this underscore the difficulty of proving liability in speculative, loosely governed digital projects.

The ruling may set a precedent that makes it harder to hold local entities accountable for global Web3 ventures.

Stablecoins

Tether Ends USDT Redemptions on Five Legacy Blockchains

Tether, the issuer of the world’s largest stablecoin, is officially ending support for USDT redemptions on five older blockchains: Bitcoin Cash, Algorand, Omni, Kusama, and Vaulta (formerly EOS).

The company announced that redemptions will cease on September 1, after which remaining tokens on those networks will be frozen.

The move follows previous halts in USDT minting across these chains, some as early as 2023. Now, the sunsetting is final.

Tether says the decision is part of a broader effort to “optimize infrastructure” and “align with community usage trends,” as the firm pivots toward more scalable and actively developed blockchain ecosystems.

In a statement, CEO Paolo Ardoino emphasized that this is less about abandonment and more about evolution.

“Sunsetting support for these legacy chains allows us to focus on platforms that offer greater scalability, developer activity, and community engagement,” he said.

Tether’s shift comes as stablecoins remain in the regulatory and market spotlight.

The GENIUS Act, now advancing through Congress, could soon establish legal guardrails for stablecoin issuers.

Meanwhile, U.S. Treasury Secretary Scott Bessent recently stated that stablecoins could help reinforce dollar dominance globally, marking a significant tone shift from U.S. policymakers.

With over $160 billion in circulation, USDT remains a foundational pillar of crypto liquidity.

But its future clearly lies in more modern infrastructure, such as Ethereum, Tron, and emerging layer-2 networks.

Holders on deprecated chains are encouraged to redeem or migrate their tokens before the September cutoff.

AI (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Markets

Bitcoin Surpasses Amazon in Market Cap, Becomes Fifth-Largest Global Asset

Bitcoin reached new heights over the weekend, crossing $123,000 and overtaking Amazon to become the fifth-largest asset in the world by market capitalization.

According to companiesmarketcap.com, Bitcoin’s market cap now stands at $2.41 trillion, ranking behind only gold, NVIDIA, Microsoft, and Apple, and ahead of both Amazon and Google.

The rally, which pushed BTC as high as $123,091 overnight, is being fueled by three major forces: sustained institutional inflows, pro-crypto policy momentum in Washington, and a macro environment increasingly favorable to risk assets.

Spot Bitcoin ETFs have attracted over $16 billion in net inflows so far this year, according to SoSoValue, helping to anchor price discovery with consistent demand.

Vincent Liu, CIO at Kronos Research, said this is not just a speculative run.

“The rally is being driven by a powerful convergence,” he explained, citing legislative activity around the CLARITY and GENIUS Acts as potential tailwinds.

Liu also pointed to rising expectations of a Fed interest rate cut as a macro catalyst that could push Bitcoin toward $130K–$150K before year-end, if retail interest reawakens.

Others echo that sentiment.

Eugene Cheung, CCO at OSL exchange, also sees upside potential, though both analysts warn that stalling ETF flows or renewed policy uncertainty could disrupt momentum.

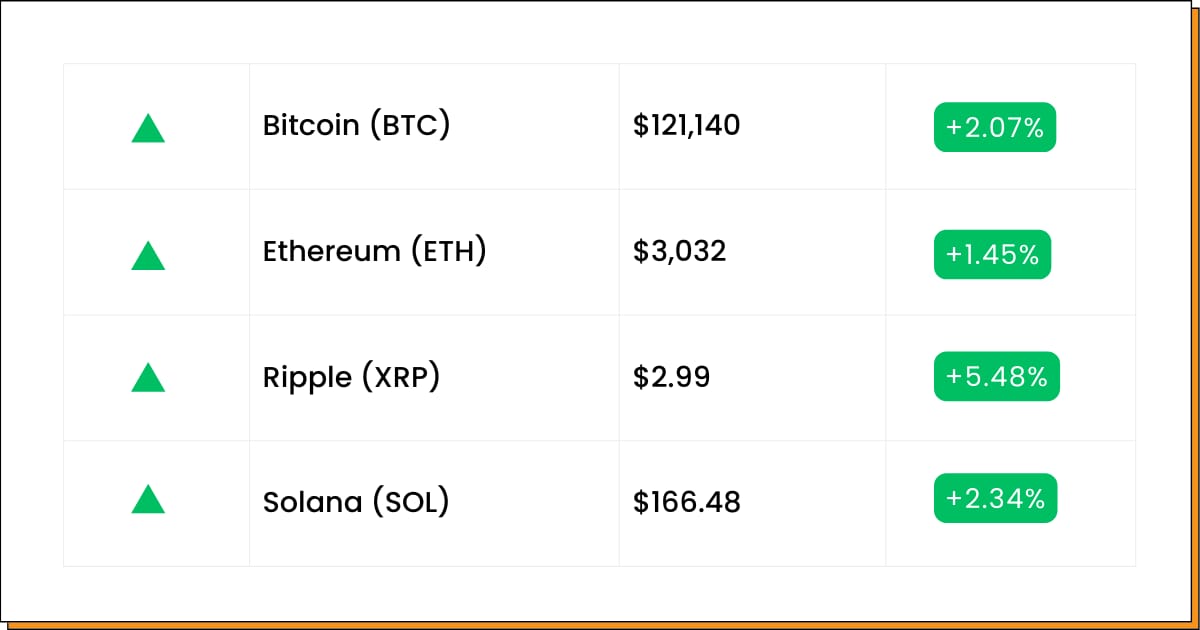

The broader market is also rising in Bitcoin’s wake: Ethereum topped $3,000, XRP hit $2.91, and Solana rose to $165.9.

The GMCI 30 Index is up 3.6% on the day, confirming broad risk-on sentiment across the crypto landscape.

Coin Leaderboard

Crypto Pulse

The headlines didn’t cover it, but traders felt it.

Microcaps lit up the charts as meme narratives, exchange events, and speculative momentum converged in a wave of high-volume moves.

While Bitcoin held the spotlight, the real action played out in the riskier corners of the market. Here's who broke out, and why.

Nubcat (NUB) $0.01965 (+50.34%)

NUB rallied on pure momentum, breaking key resistance as RSI hit overbought levels.

A MACD crossover and 57% volume spike confirmed the technical setup. No news, just traders chasing a clean chart.

BugsCoin (BGSC) $0.008447 (+55.55%)

A last-minute rush to meet Binance Alpha trading competition rules drove BGSC’s volume up 277%.

Buybacks and technical rebounds added fuel. Eyes now turn to whether post-event profit-taking will hit.

America Party (AP) $0.01375 (+66.84%)

A meme showdown on BingX between $AP and $TRUMP sent AP soaring. Low float, political narrative, and retail FOMO drove the move.

Volatility remains high as the hype cycle unfolds.

Q2 Picks (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Future Forward

In crypto, tomorrow’s breakout often hides in today’s calendar. The smartest plays don’t wait for the headlines; they get in position before the spotlight hits.

Trends start quietly. Narratives build slow. But when the pieces align, the payoff goes to those already in the room.

Crypto Conferences:

💎 Bitcoin 2140 Dubai (Jul 16, 2025)

💎 Web3 Summit 2025 (Jul 16, 2025)

💎 Invest Web3 Forum Dubai 2025 (Jul 16, 2025)

Upcoming Airdrops:

🎁 Sonic (S) S1 Airdrop Claimes Open (by Jul 15-22, 2025)

🎁 Optimism (OP) SuperStacks OP Claim (Jul 15, 2025)

🎁 ApeX (APEX) 25MM Airdrop (Jul 15, 2025)

Upcoming Token Launches:

🚀 t3rn (TRN) IDO on BSCS (Jul 14, 2025)

🚀 Soulbound (SBX) IDO on GameFi (Jul 15, 2025)

🚀 Plasma (XPL) Public Sale (Jul 17, 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is ‘Crypto Week’ and Why Does It Matter?

This week, the U.S. House of Representatives is focused entirely on crypto—reviewing three major bills that could define how digital assets are regulated for years to come.

It’s being called “Crypto Week,” and while the headlines sound political, the stakes are deeply practical for anyone using or investing in crypto.

The first bill, the GENIUS Act, sets new standards for stablecoins.

It would require stablecoin issuers to maintain 1:1 reserves in dollars or similar liquid assets, publish monthly breakdowns of those reserves, and comply with the Bank Secrecy Act.

After passing the Senate, the bill is just one House vote away from becoming law.

The CLARITY Act aims to overhaul the U.S. regulatory framework by clearly defining crypto assets as either securities, commodities, or permitted payment stablecoins.

It would limit the SEC’s reach and give the CFTC exclusive jurisdiction over certain transactions, while creating parallel rulebooks and temporary registration paths for crypto firms.

Finally, the Anti-CBDC Act would block the Federal Reserve from issuing a central bank digital currency, citing concerns about surveillance and monetary control.

Together, these bills represent a potential turning point. Supporters say they offer long-awaited clarity.

Critics say they weaken consumer protections.

Either way, the outcome could affect stablecoins, self-custody, crypto trading, and innovation in the U.S. for years to come.

Whether you’re an investor or a builder, it’s a week worth watching.

Everything Else

Digital asset fund inflows hit $3.7 billion last week, marking the second-largest weekly total on record, according to CoinShares.

Some analysts warn Bitcoin’s $122K breakout may be overextended, urging caution as key resistance levels approach.

Metaplanet’s CEO is quietly expanding a pro-Bitcoin agenda through behind-the-scenes acquisitions of Asian companies.

Solana-based game Off the Grid canceled its token and shelved its Solana plans, as developers respond to shifting market conditions.

SharpLink’s surprise $48M ETH buy boosted its stock, spotlighting renewed institutional interest in Ethereum.

That's our coverage for today; thanks for reading! Reply to this email with feedback or any cryptocurrencies you want me to check out.

Best Regards,

— Benjamin Vitaris

Crypto Intel